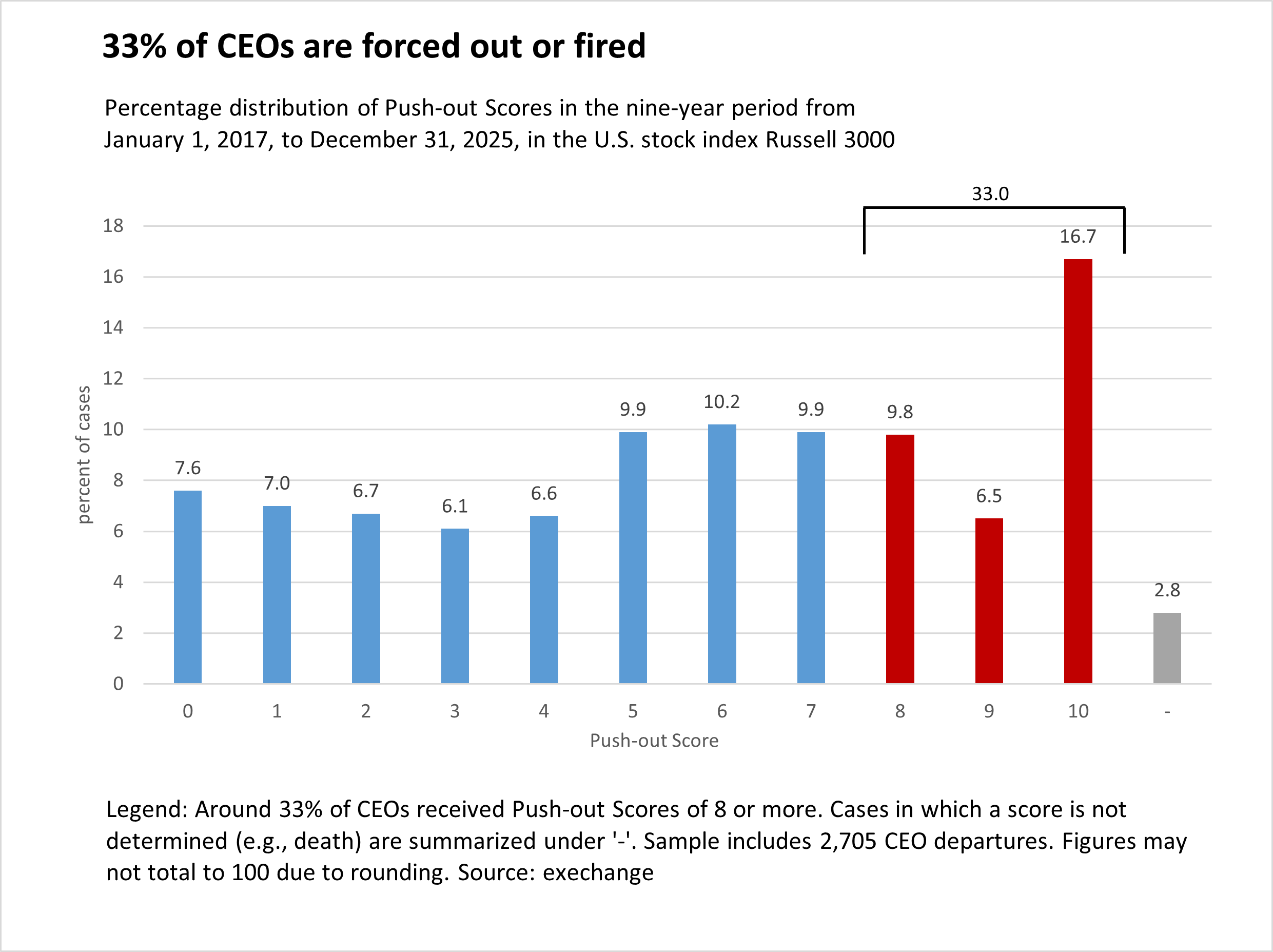

(exechange) — December 31, 2025 — Research using the Push-out Score analysis model shows that in the nine-year period from January 1, 2017, to December 31, 2025, around 33% of departing CEOs were forced out or fired.

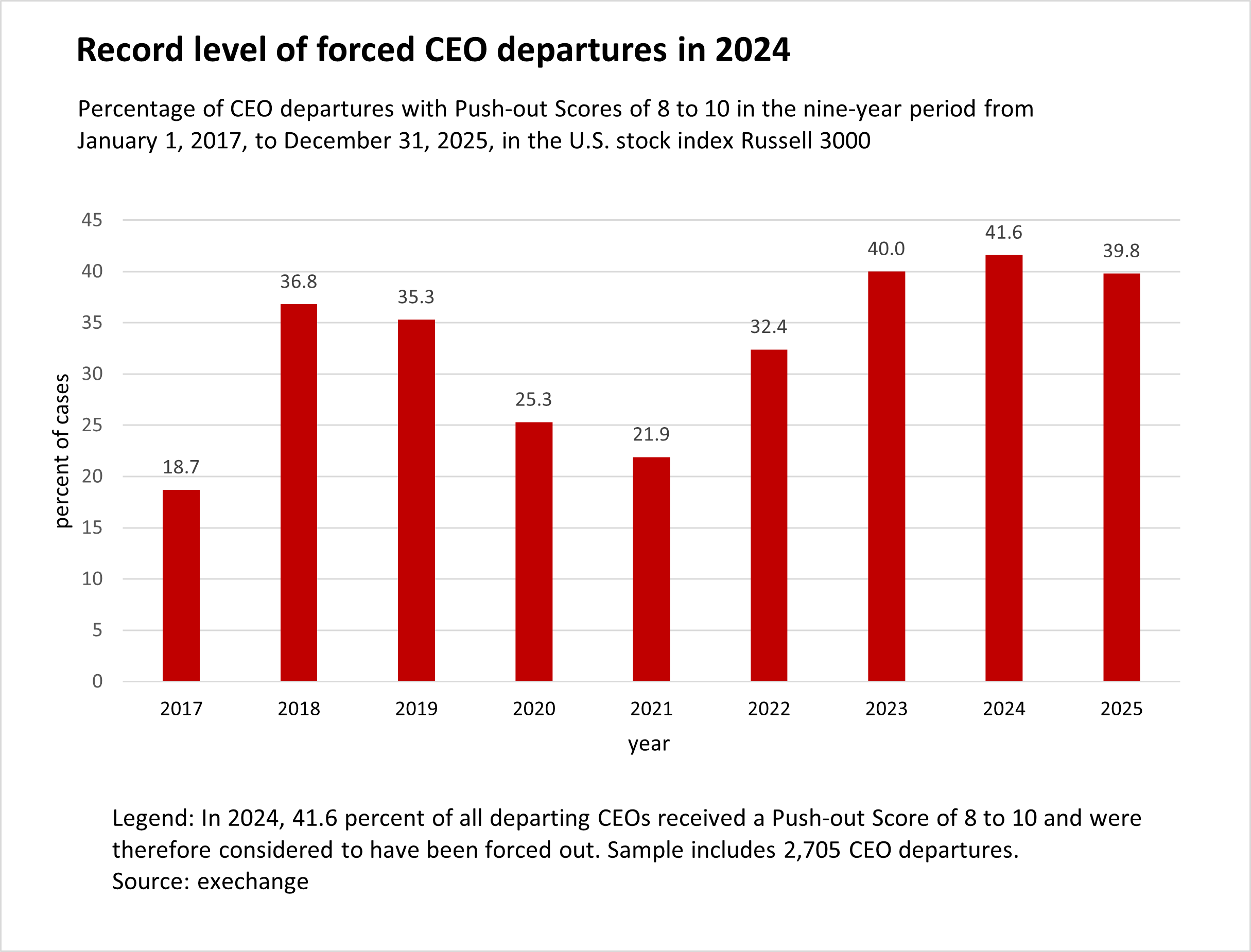

In 2025, forced CEO exits reached 39.8%, a level near the record high of 41.6% set in 2024 and significantly above the record low of 18.7% observed in 2017.

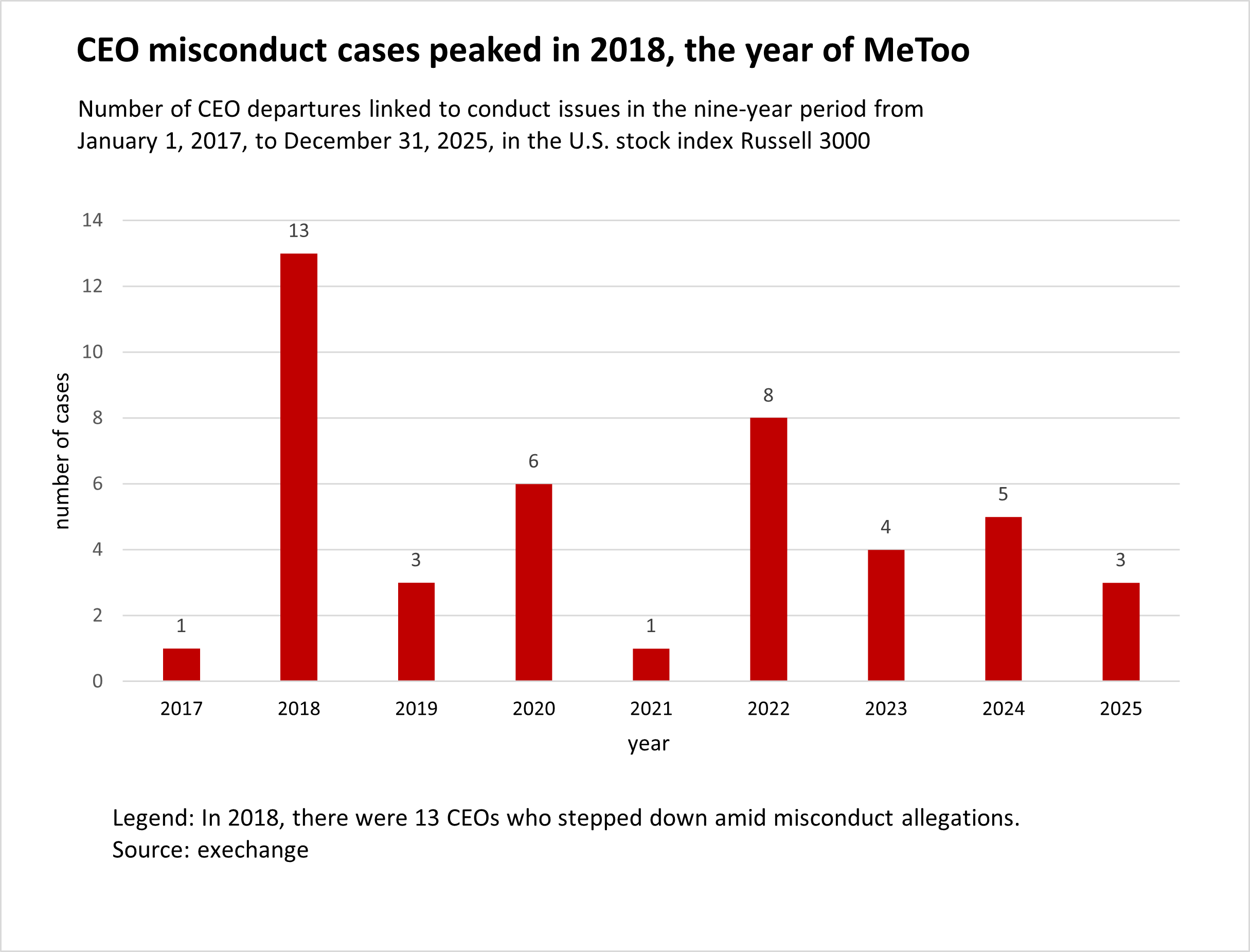

Around 1.6% of all chief executives who announced their departure from Russell 3000 companies have been ousted amid misconduct allegations. All of them were male.

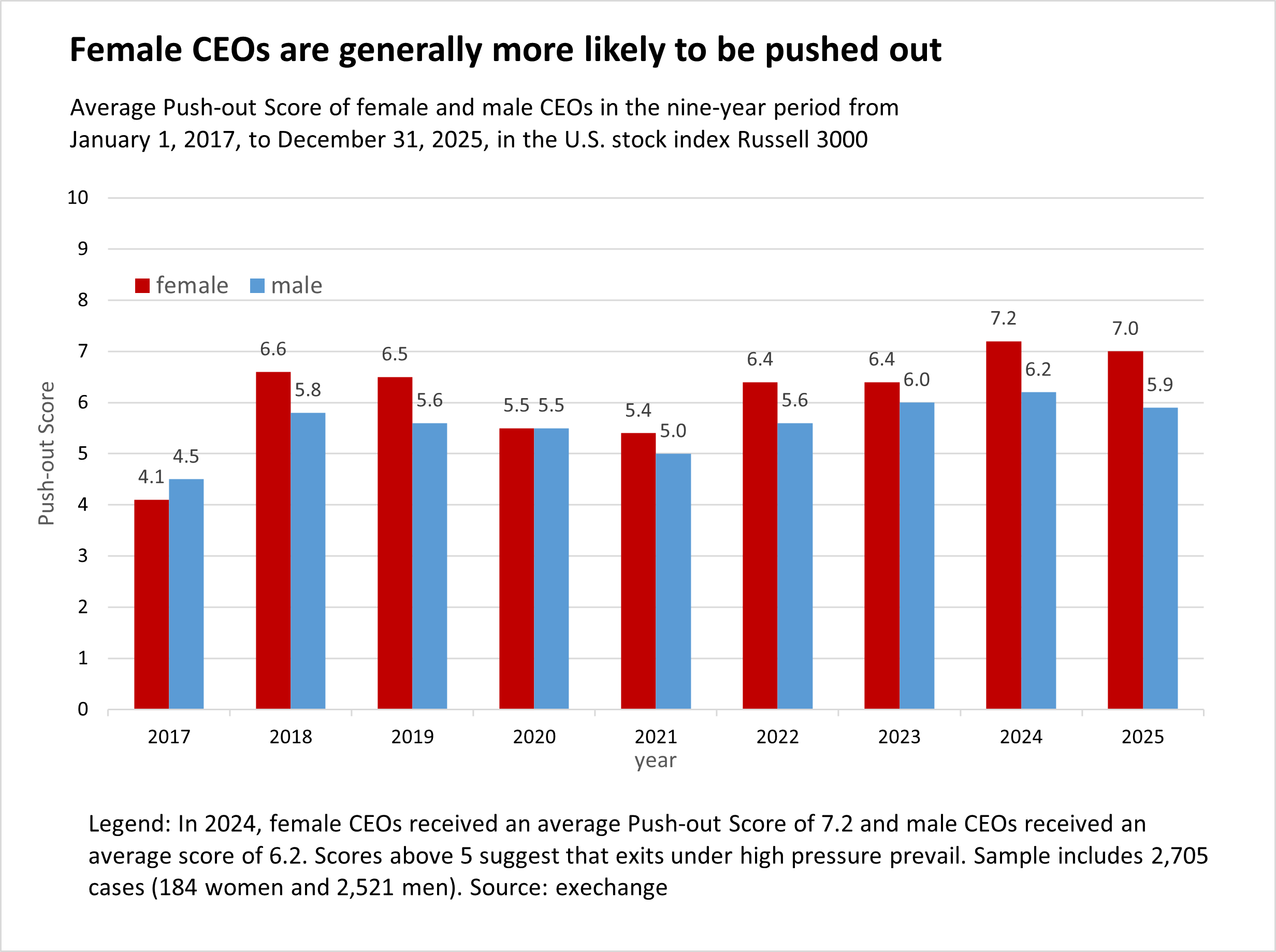

Female CEOs have been found to be more likely to be pushed out than male CEOs.

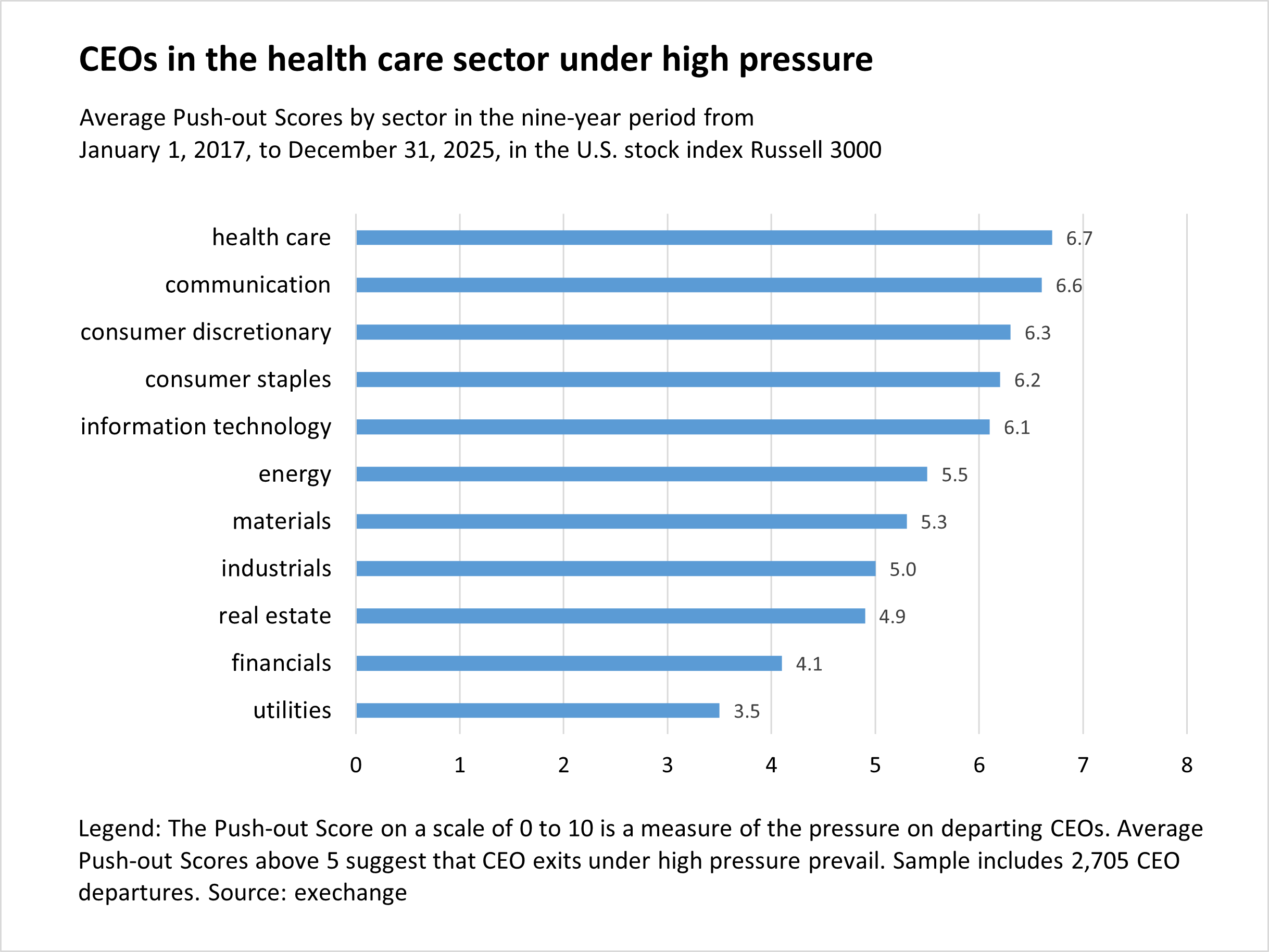

Companies in the health care, communication and consumer discretionary sectors were particularly often affected by CEO changes amid elevated pressure.

These are findings of a study conducted by CEO-exit research firm exechange, which has analyzed 2,705 CEO departures from companies in the Russell 3000 Index over the nine-year period from January 2017 to December 2025.

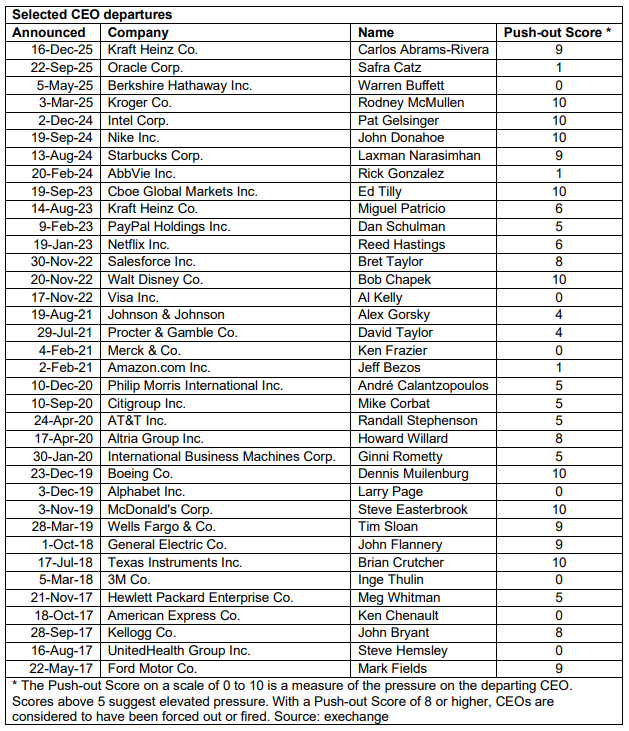

exechange tracks CEO departures at the 3,000 largest publicly traded companies in the U.S., examines the reasons CEOs leave and determines the Push‑out Score™, a measure of pressure on departing chief executives on a scale of 0 to 10.

Push-out Score

A Push-out Score of 0 indicates that the executive’s departure was almost certainly voluntary, whereas a score of 10 suggests an openly forced exit. Push-out Scores above 5 indicate that there is strong reason to believe that an executive may have been pushed out. With a Push-out Score of 8 or higher, executives are considered to have been forced out or fired.

The Push-out Score incorporates facts from company announcements and other publicly available data. It considers not only the official reason given for the departure, but also additional evidence that weighs on the credibility of that reason. The system also interprets the sometimes-cryptic language in corporate communications, using a proprietary algorithm.

The Push-out Score indicates how many of the following nine criteria are met: formal anomalies in the announcement, linguistic peculiarities, unusual age, short notice, short tenure, poor share price performance, non-transparent reason, challenging circumstances, succession issues. When the executive is openly pushed out (e.g., “terminated for cause”), then 10 points are given.

For example, a CEO in his early 50s is likely to receive a high score if he steps down at short notice after a short tenure without a comprehensible explanation and if the company’s stock price is weak, the succession plan remains unclear and the board’s praise of him is lukewarm.

Three in 10 departing CEOs were forced out or fired

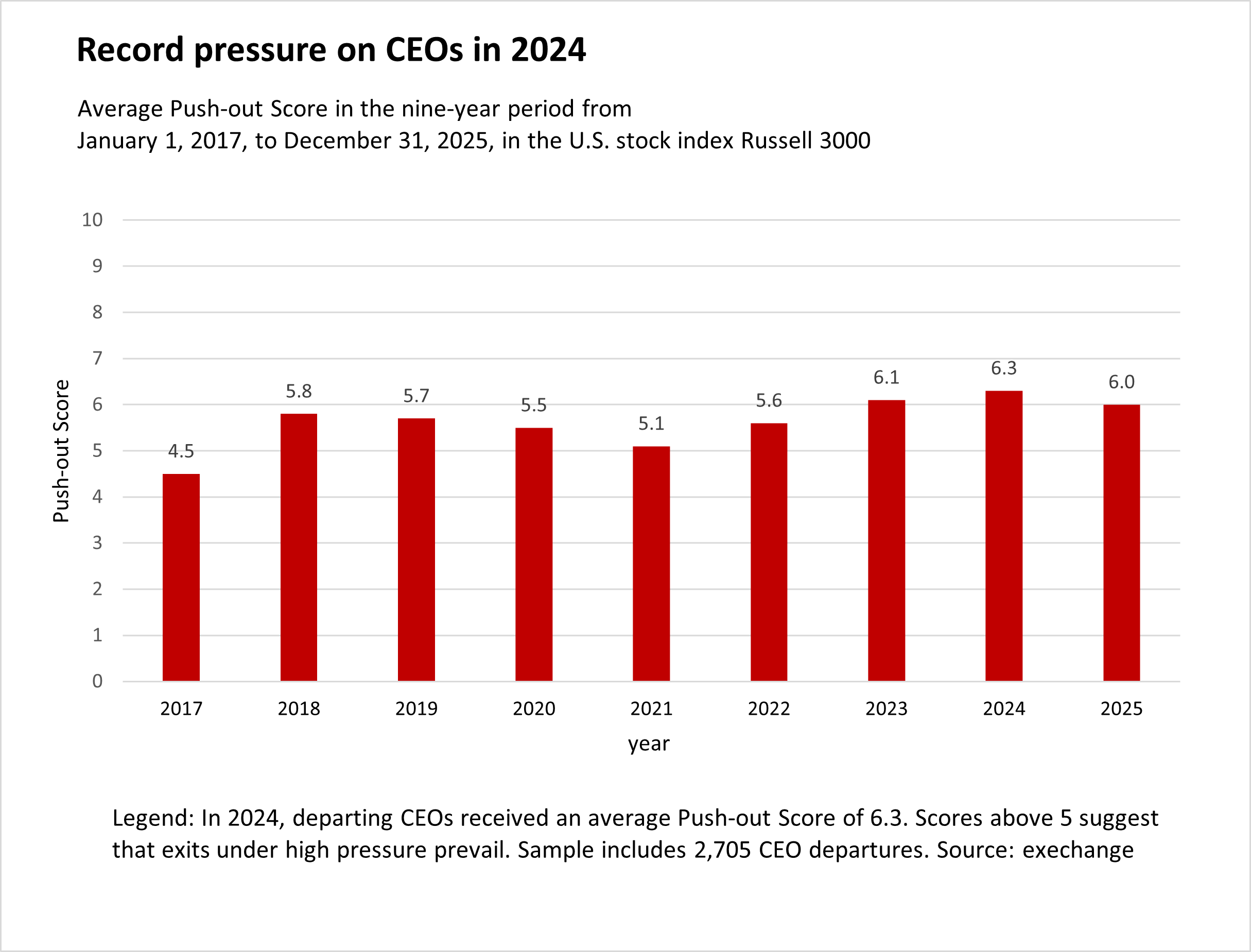

The average Push-out Score for CEO departures in the nine-year period from January 1, 2017, to December 31, 2025, was 5.7, considerably above the critical threshold of 5.

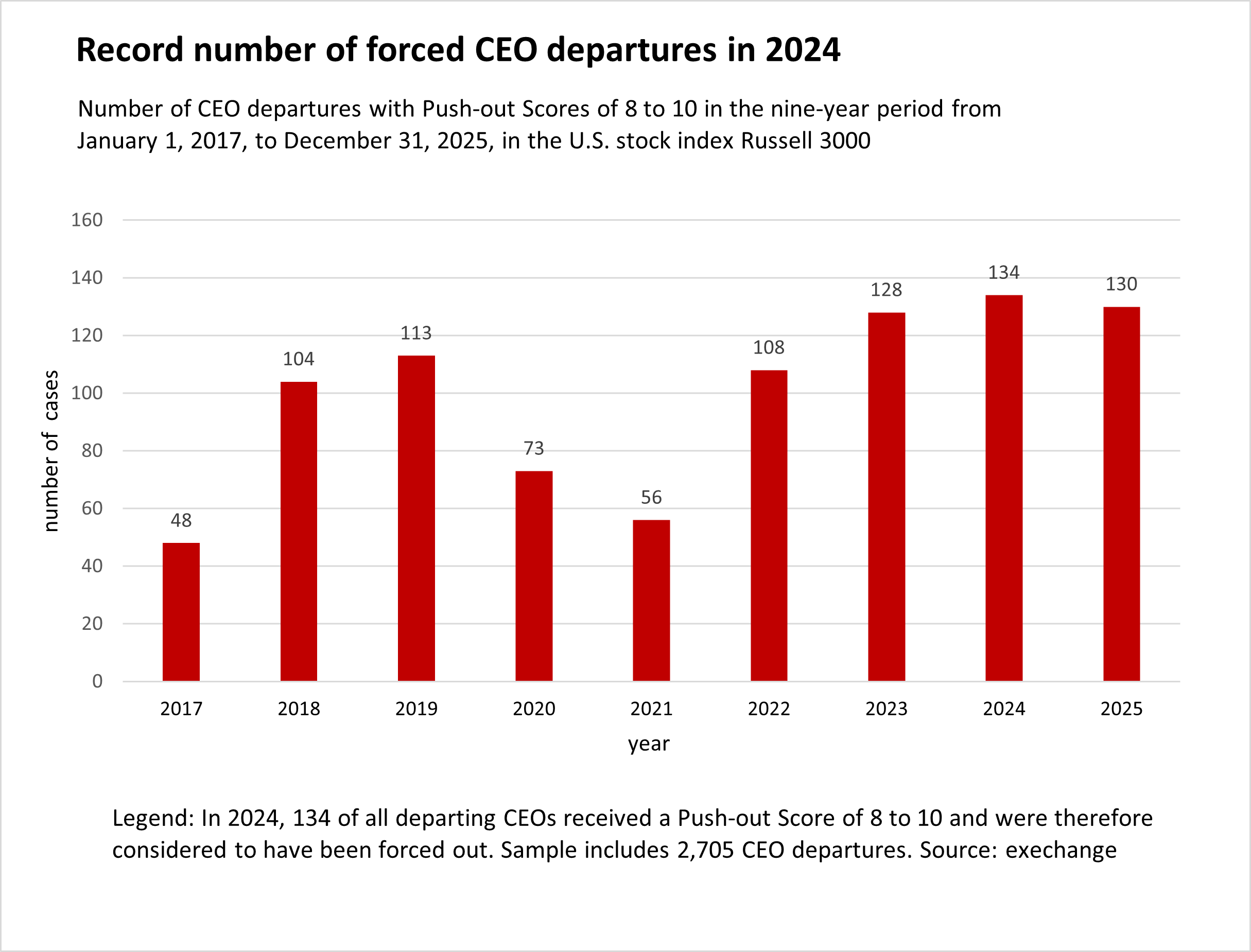

Around 33% of the CEO departure events over the nine-year period from January 2017 to December 2025 received Push-out Scores of 8 or higher.

In other words, in the nine-year period from January 2017 to December 2025, three in 10 departing CEOs were forced out or fired.

Forced CEO exits reach record high in 2024

The pressure on CEOs fluctuated greatly during the observation period.

In 2017, forced CEO departures reached a low of 18.7% amid unusually low volatility in the stock markets and in executive suites.

In 2018, the rate of forced CEO turnover rose to 36.8%, driven by a new zero-tolerance policy towards ethical misconduct in the wake of the MeToo movement and performance pressures from the escalating U.S.-China trade war.

In 2019, the percentage of forced CEO departures remained elevated at 35.3% amid persistent recessionary fears and the complexities of the U.S.-China trade war.

In 2020, boards prioritized leadership continuity to steady organizations during the Covid-19 pandemic, leading to a sharp contraction in forced CEO exits to 25.3%.

In 2021, the emphasis on organizational stability during the Covid-19 pandemic persisted, causing forced CEO departures to reach a low of 21.9%.

In 2022, the trend of leadership stability reversed as the Great CEO Resignation took hold, with forced CEO departures rebounding to 32.4% amid new geopolitical stressors such as the war in Ukraine.

In 2023, the post-pandemic era grace period ended as forced CEO departures climbed to 40% amid a sharp return to performance-based accountability.

In 2024, forced CEO departures climbed to a record-high 41.6% as boards faced the disruptive arrival of generative AI.

In 2025, the rate of forced CEO departures remained high at 39.8% as boards prioritized specialized, “AI-ready” leadership to navigate permanent strategic shifts.

The average annual Push-out Scores during the observation period reflect this trend. The lowest average Push-out Score was recorded in 2017 at 4.5, while a record high of 6.3 was reached in 2024.

A look at the number of forced CEO departures per year shows a similar pattern. In 2017, there were 48 forced CEO departures, the lowest figure in the observation period. In 2024, a record number of 134 forced CEO exits were recorded.

Starbucks: A typical example of a CEO departure with a high Push-out Score

A typical example of a CEO departure with a high Push-out Score is the exit of Starbucks Corp. CEO Laxman Narasimhan. Starbucks Corp. announced in a news release on Tuesday, August 13, 2024, that Laxman Narasimhan was “stepping down” from his role as CEO and as a member of the board, effective immediately. The Push-out Score was determined to be 9 because the following nine criteria were fulfilled:

- Low age (Narasimhan was 57 years old as of the announcement date)

- Short notice (Narasimhan left his post abruptly)

- Short tenure as CEO of Starbucks (one year and five months)

- Conspicuous stock price performance (Starbucks Corp.’s share price had declined more than 20% since Narasimhan took the CEO post)

- Non-transparent reason (a reason for his departure was not explicitly provided)

- Critical time (Starbucks had come under pressure from activist investors Elliott Investment Management and Starboard Value; three months ago, Starbucks had cut its financial outlook for the second time in 2024 as the company dealt with tougher competition in China; former CEO Howard Schultz had publicly criticized how Starbucks was managed)

- Succession issues (Narasimhan’s successor was brought in from outside; Starbucks poached Chipotle Mexican Grill Inc. CEO Brian Niccol to take over)

- Formal anomalies in the news release (Narasimhan received praise, thanks and good wishes, but no accolades for concrete and quantified financial successes and no word of regret; a statement from Narasimhan regarding his move was not included in the release)

- Linguistic conspicuities in the communication (Howard Schultz, Starbucks founder and former CEO, showered incoming CEO Brian Niccol with advance praise in the announcement, but did not say a personal word about departing CEO Laxman Narasimhan. This was all the more remarkable given that Schultz had been full of praise for Narasimhan before his hand-picked successor took office, stating in a message to employees on September 1, 2022, regarding Narasimhan’s appointment: “I am thrilled to announce that we have identified an individual with the ideal background, knowledge, and demonstrated track record of living his values to lead Starbucks into the future.”)

It was telling that although Starbucks did not give an explicit reason for the CEO change in the official announcement, the company clearly alluded to performance problems. Mellody Hobson, Starbucks board chair, put her finger in the wound by saying with regard to incoming CEO Brian Niccol that he was a “culture carrier” with a “proven track record of driving innovation and growth” and that Niccol “understands that a remarkable customer experience is rooted in an exceptional partner experience.” All of this could be interpreted as indirect criticism of the outgoing CEO.

One day after announcing the obviously involuntary departure of Laxman Narasimhan, Starbucks stated in a regulatory filing published on Wednesday, August 14, 2024: “Mr. Narasimhan’s departure is not related to any disagreement between Mr. Narasimhan and the Company.” At the same time, Starbucks also stated: “Mr. Narasimhan’s separation from the Company is a termination by the Company ‘without cause.’”

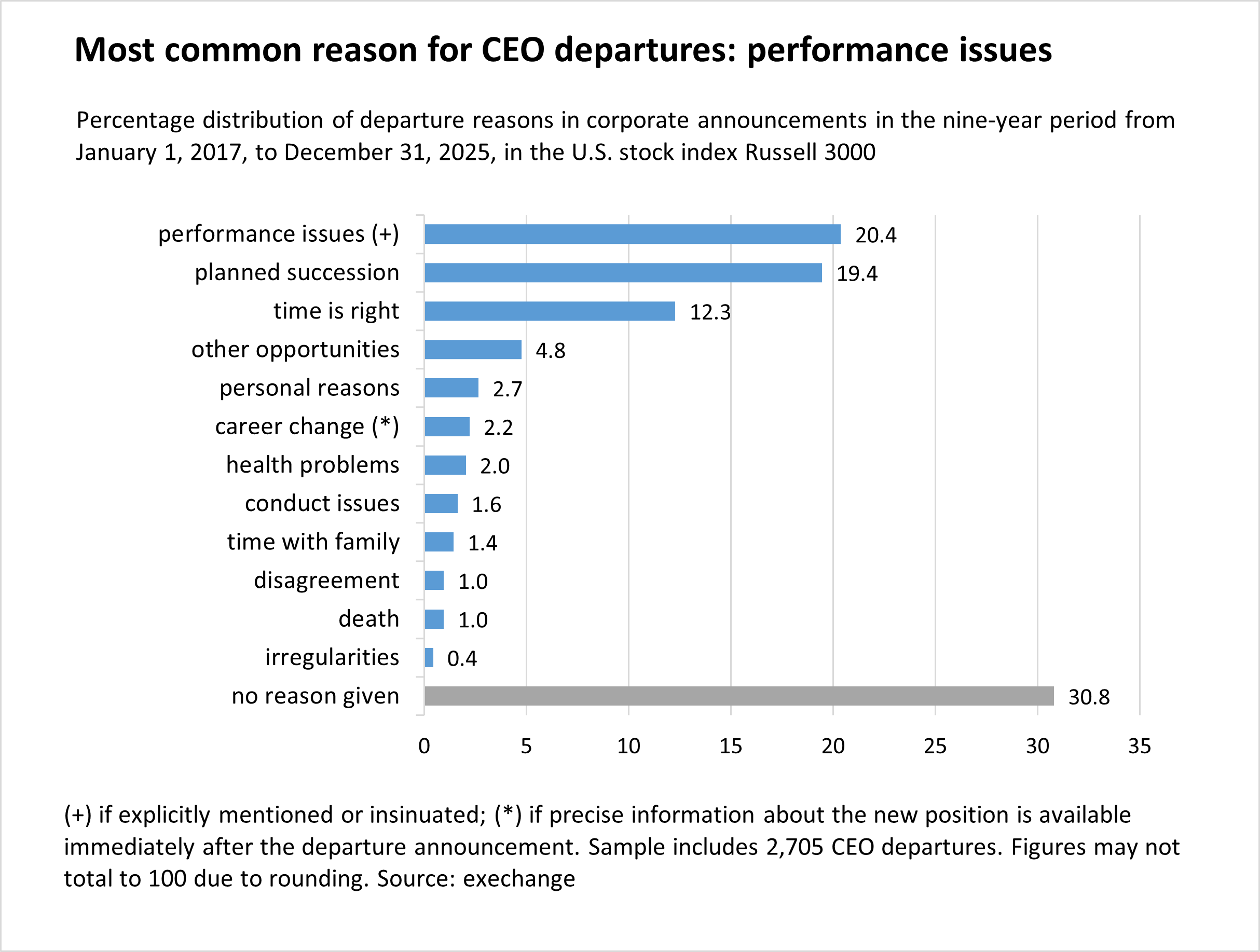

Performance issues are the main reason for CEO departures

In the nine-year period from January 1, 2017, to December 31, 2025, around 30.8% of the official CEO-departure announcements did not include any reason for the change. In 20.4% of cases, companies cited performance issues. In some of those cases, this was done quite bluntly. Far more often, however, companies point to performance issues (including mindset and skillset issues) through indirect or hidden criticism of the outgoing CEO. In 19.4% of cases, CEO changes were explained by the fact that a succession plan that had been in place for some time was now being implemented.

Around 4.8% of CEOs departed “to pursue other opportunities” and around 1.4% “to spend time with their family,” statements that are sometimes taken as code for firings.

Around 2.7% left for “personal reasons,” and around 1.6% departed amid misconduct allegations.

CEOs who departed “to pursue other opportunities” received an average score of 7.6. CEOs who left “to spend time with their family” received an average score of 5.7, and CEOs who stepped down for “personal reasons” received an average score of 7.2.

Companies are, within certain limits, not necessarily required to reveal the reason for a CEO departure. However, if they consider it appropriate, they may give a reason for the move, for example to curb speculation.

SEC requirements regarding the announcement of a CEO departure

The Securities and Exchange Commission (SEC) requires that public companies must issue a securities filing called an 8-K within four business days if a major event relevant to shareholders occurs (see https://www.sec.gov/files/form8-k.pdf). While Item 5.02(b) of Form 8-K requires companies to disclose when a principal executive officer “retires, resigns or is terminated from that position,” companies only need to “disclose the fact that the event has occurred and the date of the event.”

However, the SEC does not explicitly require companies to provide a reason for the departure.

If the CEO is also a director, which a CEO often is, and departs in their capacity as a director because of a disagreement with the company “on any matter relating to the company’s operations, policies or practices,” or has been removed for cause from the board of directors, item 5.02(a) of Form 8-K requires the company to disclose “a brief description of the circumstances representing the disagreement that the registrant believes caused, in whole or in part, the director’s resignation, refusal to stand for re-election or removal.”

The SEC does not detail how specific that description must be.

In cases where companies choose to disclose additional details about the leadership change, such as a specific reason for the move or the extent to which the CEO’s departure was voluntary or forced, a sense of responsibility is crucial. When companies make statements, they must act responsibly, including endeavoring to ensure the statements are not false or misleading and do not omit information a reasonable investor would consider important in making an investment decision.

Given all these circumstances, board members must perform a difficult balancing act in order to fulfill their disclosure obligations while acting in the best interests of the company and its shareholders and protecting the personal rights of the departing CEO.

As a result, companies tend to give only vague reasons, if any, for the departure of a CEO, even when serious shortcomings on the part of the CEO are obvious.

In particular, the hurdles for termination “for cause” are generally high, which is why they are extremely rare. Generally, the employment agreement between the company and the CEO explicitly defines the circumstances under which the CEO can be terminated “for cause” — for example in the event of dishonesty, fraud, embezzlement, misappropriation of funds, misconduct or failure to adhere to corporate codes. It is often difficult, distracting and time-consuming for a company to even attempt to terminate a CEO “for cause”. The standards for a showing of cause are often stringent, and as a result there may be considerable litigation risk. Therefore, terminations “for cause” are usually pursued only in the most blatant circumstances.

Resigned? Retired? Terminated with or without cause?

For this reason, companies often find themselves in an area of tension when they have to decide whether a CEO can be terminated “for cause” or whether a termination without cause or a formally voluntary resignation is possible. In rare cases, this tension is publicly visible, as the following example shows.

In this case, the company announces that its CEO “resigned and retired from his positions with the Company as President, Chief Executive Officer, Principal Executive Officer and Director on the Company’s Board of Directors”, while the company also states that “after consideration of various alternatives, including termination with or without cause, the board accepted [the CEO’s] resignation,” further stating that “[i]n connection with [the CEO’s] resignation, the Board exercised its discretion to make the determination that it is in the best interests of the Company and its stockholders to accept [the CEO’s] resignation and provide certain compensation and benefits to [the CEO] in exchange for his continued assistance, consulting and other obligations, as set forth in a Separation Agreement between [the CEO] and the Company …”

Misconduct

Companies often take advantage of the opportunity to combine the leadership change with a message or a moral, particularly in the case of alleged misbehavior. In the nine-year period from January 2017 to December 2025, exechange recorded 44 CEO changes in the Russell 3000 Index that were related to misconduct allegations.

In all cases of alleged conduct issues, the CEOs involved were male.

In 2018, which was dominated by the MeToo movement, the number of conduct-related CEO departures reached a record high of 13 cases.

The 44 cases of alleged CEO misconduct counted from January 2017 to December 2025 included:

- 7 cases of relationships with employees;

- 6 cases of disrespectful behavior;

- 4 cases of employee matters that were not further specified;

- 4 cases of violation of fiduciary duties;

- 3 cases of workplace culture issues;

- 2 cases of sexual misconduct;

- 1 case of bribery;

- 1 case of private tax fraud;

- 1 case of inappropriate comments;

- 1 case of domestic violence.

The remaining 14 misconduct cases related to unspecified violations of company standards.

Closer look at female CEOs

Female CEOs in the U.S. have been found to be more likely to be pushed out than male CEOs. Over the nine-year period from January 2017 to December 2025, outgoing female CEOs have received an average Push-out Score of 6.3, considerably above the average Push-out Score of 5.6 for outgoing male CEOs.

From 2018 to 2025, the annual average Push-out Scores of female CEOs were consistently higher or equal to those of male CEOs.

Female CEOs have a 32% shorter tenure. Women in the role step down after an average tenure of 6 years, compared with 8.8 years for men, the exechange data shows, which covers 184 departing female CEOs and 2,521 departing male CEOs.

Average tenure of 8.6 years

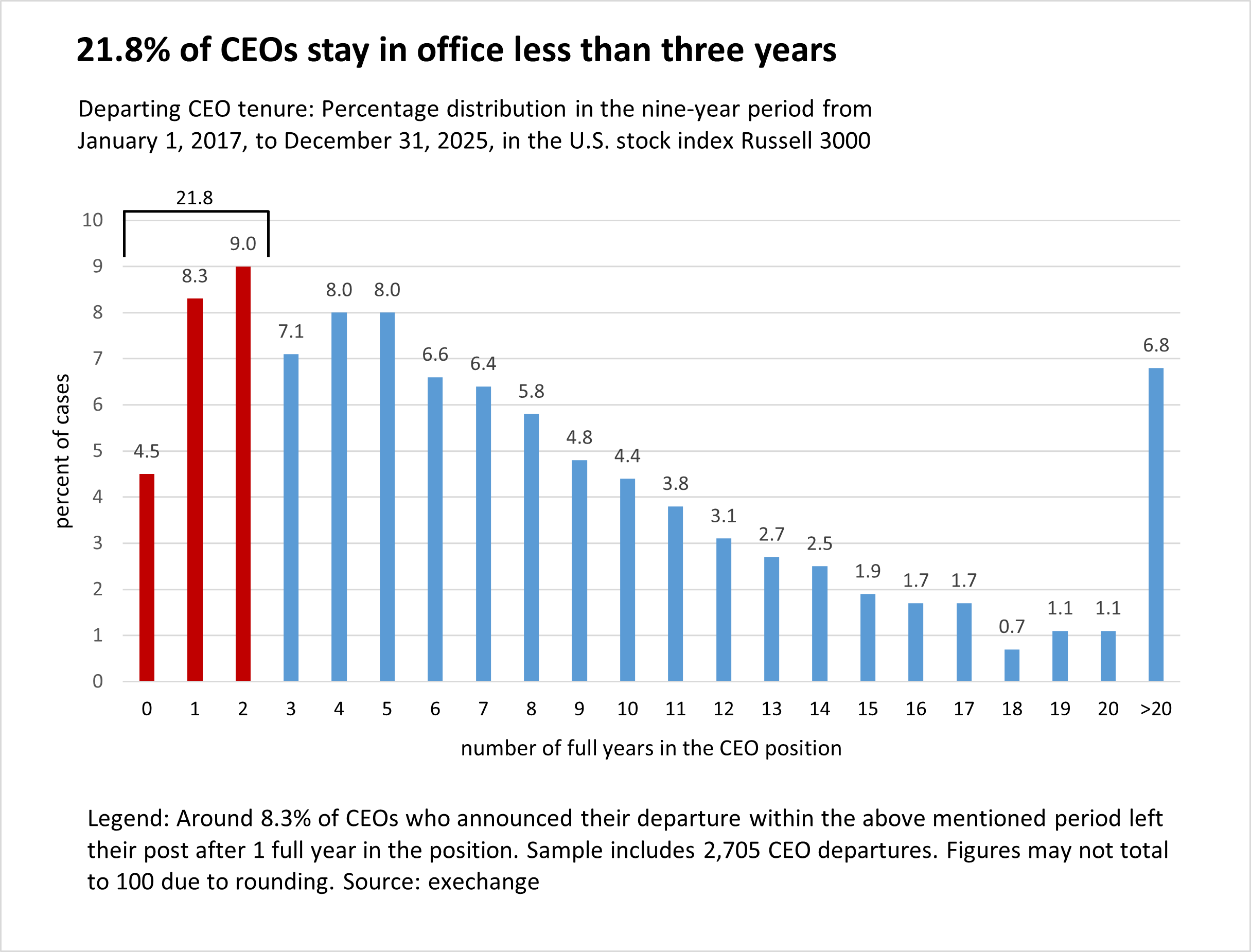

In the U.S., the average tenure of departing CEOs in the nine-year period from January 1, 2017, to December 31, 2025, was 8.6 years. Around 21.8% of CEOs stay in office less than three years.

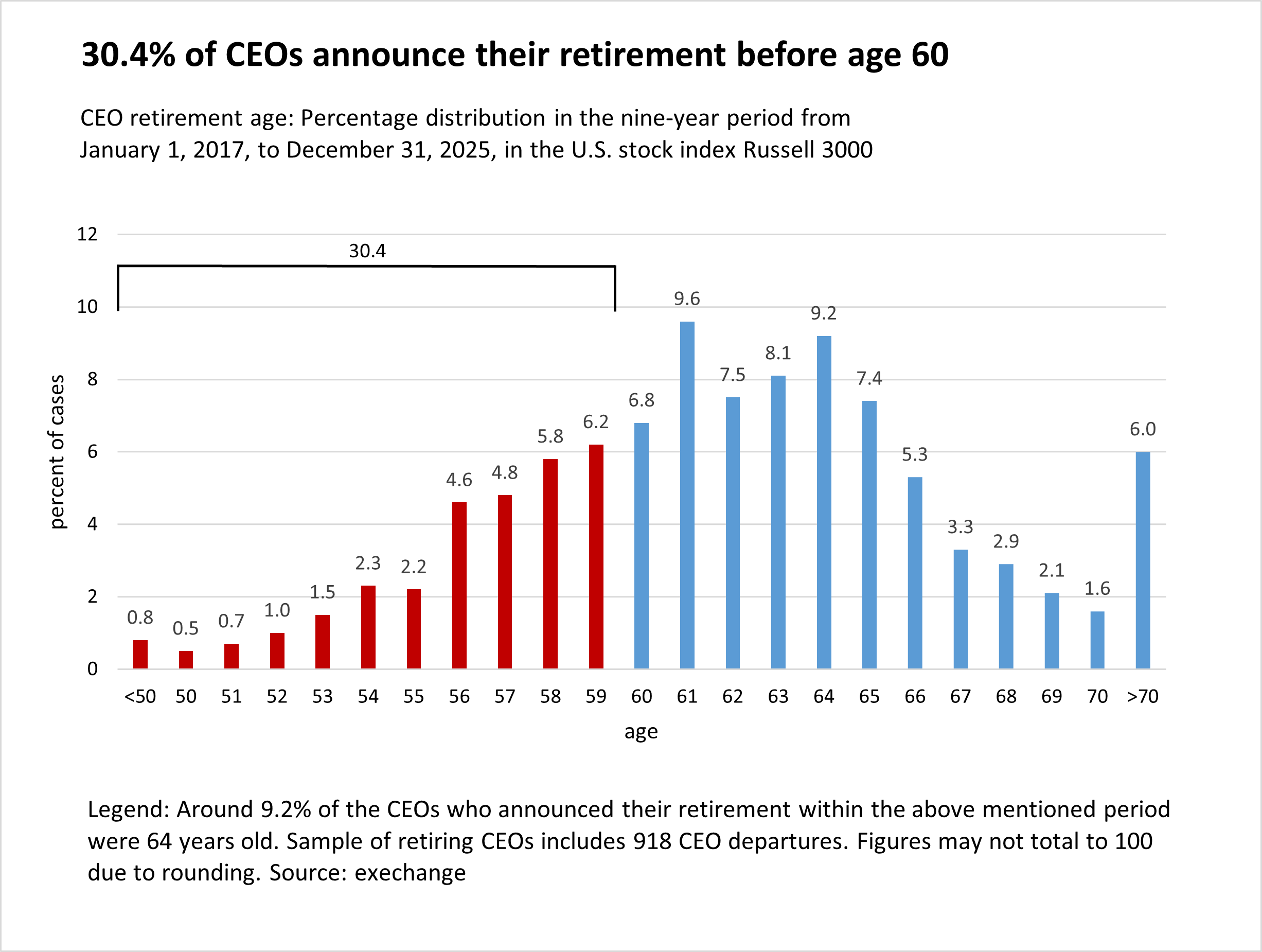

The average CEO retirement age in the U.S. was 62.1 years. Around 30.4% of CEOs announce their retirement before age 60.

The range of CEO tenures is extremely broad.

- Only seven days in office was Talis Biomedical Corp. CEO Brian Blaser when he stepped down “due to personal matters” on December 8, 2021.

- After just 34 days in office, Axalta Coating Systems Ltd. CEO Terrence Hahn had to vacate his post amid misconduct allegations on October 8, 2018.

- After less than seven weeks in the role, Texas Instruments Inc. CEO Brian Crutcher resigned “due to violations of the company’s code of conduct” on July 17, 2018.

At the same time, CEOs can also hold office for more than five decades.

- With 60 years of continuous leadership, among them 56 years as CEO and Chairman, Berkshire Hathaway Inc. CEO Warren Buffett announced his plan to exit from his post at the end of 2025 during the annual meeting on May 3, 2025.

- 57 years in office was L Brands Inc. CEO Les Wexner when he announced his departure on February 20, 2020.

- After 54 years in office, SEI Investments Co. CEO Al West announced his retirement on April 4, 2022.

CEOs say an average of 79 words on their departure

Many CEOs leave without a word. In the nine-year period from January 1, 2017, to December 31, 2025, around 26.8% of all outgoing CEOs remained silent in the departure announcement, according to data compiled by exechange. Departing CEOs who did make a statement said an average of 79 words. The longest statement was 793 words, and the shortest statement was 6 words.

- The shortest departure statement came from AutoNation Inc. CEO Carl Liebert, who agreed in 2019 after less than five months in the role that he would leave to pursue other interests, stating: “I wish AutoNation nothing but success.”

- Only marginally more eloquent was Axalta Coating Systems Ltd. CEO Terrence Hahn, who bowed out in 2018 amid misconduct allegations with a 10-word statement, saying: “I wish the best to Axalta’s employees and its leadership.”

- An 18-word statement was issued by Renewable Energy Group Inc. CEO Dan Oh, who resigned in 2017 after almost six years in the post, declaring: “I am extremely proud of the REG team and the success we achieved over the past ten years.”

Leadership transitions in which departing CEOs provide conspicuously short or no explanations for their move are statistically associated with elevated pressure and show an increased incidence of Push-out Scores above the critical threshold of 5. In contrast, leadership changes are statistically associated with low pressure when departing CEOs say favorable words about their successor instead of praising themselves.

The following quote from Visa Inc. CEO Al Kelly is a good example of a departure statement that accompanies a smooth handover. In the release dated November 17, 2022, announcing the upcoming transition from CEO Al Kelly to Ryan McInerney, outgoing CEO Al Kelly said 90 words, praising his successor: “I cannot think of a finer leader to continue to position Visa at the center of money movement in increasingly innovative ways. Ryan has boundless energy and passion for this business and in his role as President, and as my close partner for the past six years, he has become intimately familiar with how Visa operates and the exciting opportunities this industry presents. I feel privileged to entrust Ryan with the leadership of this great company and am confident Visa is poised for more success in the years to come.”

The longest departure statement with 793 words came from the founders of Alphabet Inc., Larry Page (CEO) and Sergey Brin (President), who left their roles in 2019. Page and Brin stated in their lengthy message, among other things: “The company is not conventional.”

Three sectors with particularly high pressure

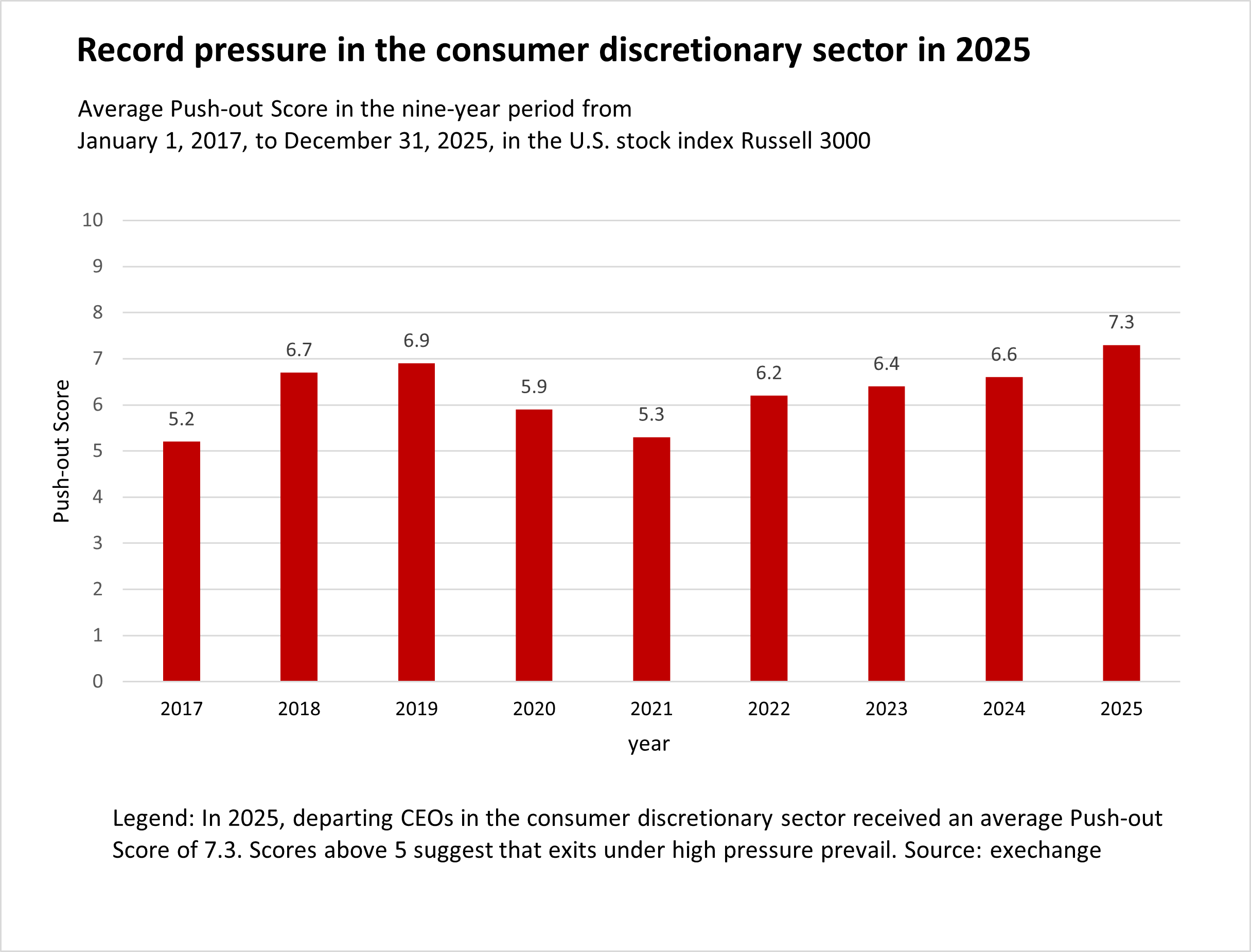

Over the nine-year period from January 2017 to December 2025, the average Push-out Scores in seven out of 11 sectors have been above the critical threshold of 5. The highest average Push-out Scores in the U.S. were determined in the health care sector with 6.7, in the communication sector with 6.6 and in the consumer discretionary sector with 6.3.

The lowest average Push-out Scores were determined in the utilities sector with 3.5, in the financials sector with 4.1 and in the real estate sector with 4.9.

In the consumer staples sector, the average Push-out Score was 6.2, in the information technology sector it was 6.1, in the energy sector it was 5.5, in the materials sector it was 5.3, and in the industrials sector it was 5.

However, the pressure on CEOs in the individual sectors also fluctuated considerably over the years.

In 2025, the consumer discretionary sector recorded an average Push-out Score of 7.3, reaching a record high.

Examining CEO departures since 2017 in detail

This study is based on 2,705 individual CEO departures of companies listed in the Russell 3000 Index, which provides a homogenous and wide data pool for the analysis of CEO departures.

The Russell 3000 seeks to be a benchmark of the entire U.S. stock market and encompasses the 3,000 largest U.S.-traded stocks, in which the underlying companies are all incorporated in the U.S.

The exechange study documents and analyzes CEO departure events of Russell 3000 companies, updating a database first introduced in 2017. For methodological reasons, the database excludes departures of interim CEOs and departures related to corporate restructurings such as mergers, takeovers and spin-offs.

Corporate governance experts from Stanford University, Harvard University and Yale University have investigated exechange’s analysis model and found that Push-out Scores are positively correlated with stock market volatility. See https://www.gsb.stanford.edu/faculty-research/working-papers/retired-or-fired-how-can-investors-tell-if-ceo-was-pressured-leave/ and https://www.gsb.stanford.edu/faculty-research/publications/firing-hiring-ceo-what-does-ceo-turnover-data-tell-us-about/

Academic studies with Push-out Scores

The exechange database is used by researchers to investigate CEO departures. Publications using exechange data and Push-out Scores include the following:

Cook, A., Glass, C., & Ingersoll, A. (2024). Antecedents and repercussions of CEO dismissals in the US: A glass cliff for women CEOs? Journal of General Management. https://doi.org/10.1177/03063070241309690

Cook, A., Glass, C., & Ingersoll, A. (2024). Leading while female: Analyzing women CEOs’ post‐appointment trajectory. Social Science Quarterly. https://doi.org/10.1111/ssqu.13473

Gow, I. D., Larcker, D. F., & Tayan, B. (2017). Retired or fired: How can investors tell if a CEO was pressured to leave? Rock Center for Corporate Governance, Stanford Closer Look Series. https://ssrn.com/abstract=2975805

Larcker, D. F., Tayan, B., & Watts, E. M. (2022). Firing and hiring the CEO: What does CEO turnover data tell us about succession planning? Rock Center for Corporate Governance, Stanford Closer Look Series. https://ssrn.com/abstract=4079127